Wealth 20/20 is a third-party platform with all of your financial information securely held in one place. This includes Financial Dashboard, Investments, Spending/Budgeting, Insurance, Property, Cash Flow & Retirement Planning, and secure document storage. If you do not already have Wealth 20/20 access, please contact our office at 1-866-WCP-PLAN to inquire.

OVER 35 YEARS OF OPEN ARCHITECTURE, TRANSPARENT RETIREMENT EXPERIENCE

WHY NEW ENGLAND PENSION

OUR EXPERIENCE

With a history dating back to 1986, New England Pension Plan Systems (NEPPS) is a national, full-service retirement-plan consulting firm, now offered by Edelman Financial Engines. We provide sophisticated retirement programs tailored to each client’s needs with comprehensive attention to detail. Learn more about the benefits of an open architecture, transparent retirement experience.

OUR MISSION

To educate retirement plan sponsors and participants, with the resources and information necessary to navigate the various complex retirement decisions in a cost-effective environment.

OUR PHILOSOPHY

To promote financial independence using practical education, workshop learning, integrated technology and understanding while listening to client needs in a face-to-face relationship.

COMPLETE RETIREMENT PLAN PLATFORM

Comprehensive plan compliance and fiduciary governance made available through:

- Dedicated customer service

- Open architecture transparent retirement solutions

- Understanding your retirement needs and working for you

Our daily-valued platform offers extensive plan options, control, and flexibility, with attention dedicated to participant education.

Announcement

As of December 12, 2023, New England Pension Plan Systems is now part of Edelman Financial Engines. This allows us to continue our tradition of offering exceptional service, education, and financial planning to our employee and participant benefit plans. Together with Edelman Financial Engines, we aim to enhance services for all our clients, helping you have peace of mind regarding your retirement plan needs.

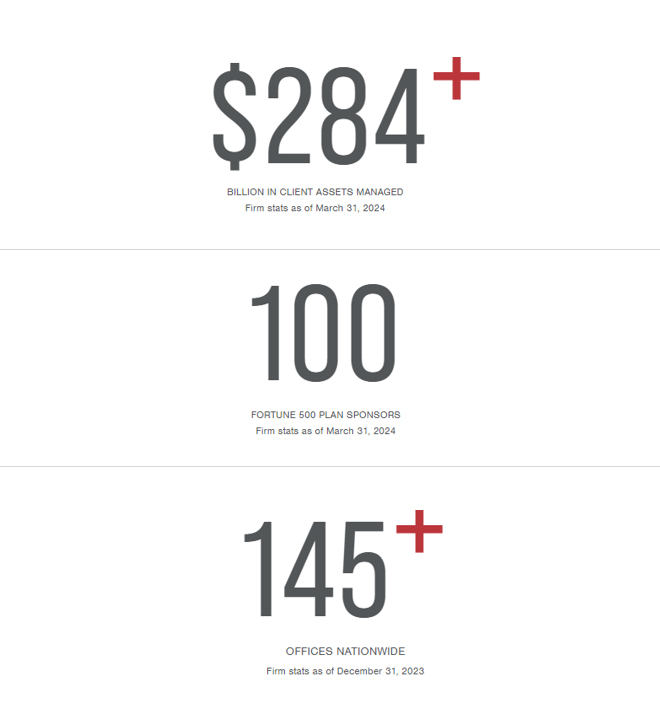

Edelman Financial Engines is privileged to provide advice and services for employer-sponsored plans of some of America’s best-known companies through our workplace and wealth planning services.